Your search for high dividends on a checking account ends here. Meet Rewards Checking. In addition to all the standard great benefits of a Heritage account, this checking account also offers exclusive perks every month. It’s also the only way to get the perfect companion to Rewards Checking, the Rewards Savings – the savings account that collects and grows these rewards automatically.

Perks You Say? These rewards are next level good!

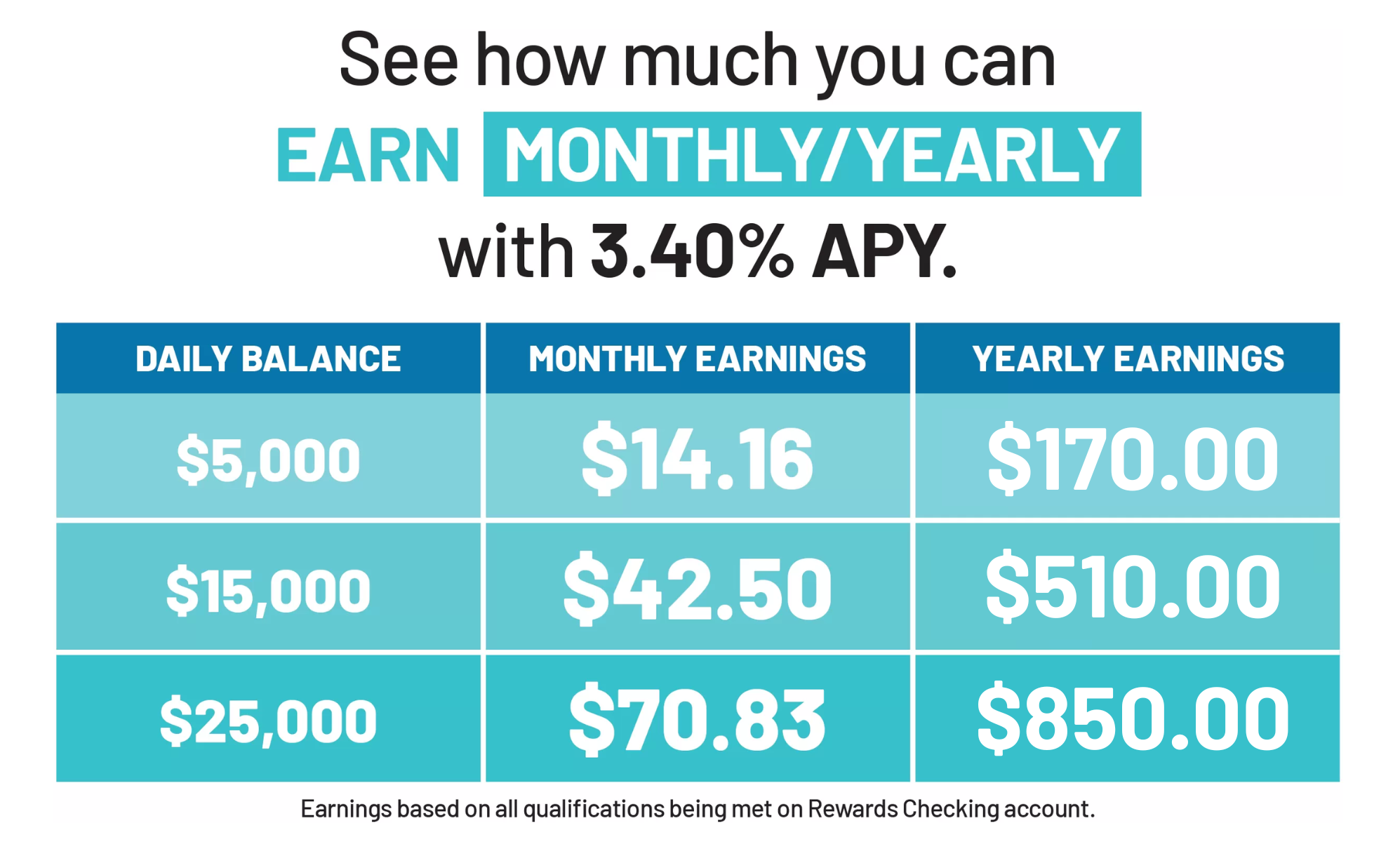

- 3.40% APY1 on balances up to $25,000 if qualifications are met

- 3.40% to 1.07% APY on balances over $25,000 if qualifications are met

- 0.05% APY if qualifications are not met

- Refunds on ATM withdrawal fees, nationwide (up to $25 monthly)2

- Link to free Rewards Savings to build savings automatically while you sleep, it does the work for you!

- No minimum balance to earn reward

- No monthly maintenance fee

- Free Digital Banking

- Free Bill Pay

- Free eStatements

- Free Instant Issue Visa® debit card at account opening

- $50 minimum deposit to open

Qualifying for rewards is a breeze

Enrollments must be in place and all of the following transactions and activities must post and settle to your Rewards Checking account during each Monthly Qualification Cycle.

- At least 12 debit card purchases

- Log into your Digital Banking account

- Enroll in eStatements

- At least 1 direct deposit into the account

If for some reason you don’t meet these qualifications, don’t worry — you’ll still earn our base rate. Plus, you can get right back to earning your full rewards the very next month!

OPEN A REWARDS CHECKING ACCOUNT

1APY=Annual Percentage Yield. APY is accurate as of 09/30/2022. The APY range calculation is based on an assumed account balance cap of $25,000 plus $100,000. The APY decreases as your balance increases above $25,000. Enrollments must be in place and all the following transactions and activities must post and settle to the member’s Reward's Checking account during each Monthly Qualification Cycle to receive the 3.40% APY: 12 (pin-based/signature-based) debit card purchases, enrolled in and logged into digital banking, at least 1 direct deposit into the account, enrolled to receive e-statements. 0.05% APY on all balances, even if qualifications are not met. Ability to earn $849 yearly based on maintaining a monthly balance of $25,000 in the Rewards Checking account and meeting all requirements to earn $70.83 each month x 12 = $849.96. Rates and rewards are variable and may change at any time without notice after the account is opened. $50.00 minimum balance to open. Fees or other conditions could reduce earnings on the account. Program rates, terms, and conditions are subject to change without notice. Membership restrictions may apply.

2ATM fee refunds up to $25.00 per monthly qualification cycle, maximum $5.00 per transaction. Program terms and conditions are subject to change without notice. Membership restrictions may apply.

Go to main navigation