Let’s talk Investment Strategy.

Where do you see yourself in the future? Do your financial plans align with those goals? We understand that your needs, timeline and budget are as unique as you are, and we’ve assembled a team of professionals who care as much about your future as you do. Let’s start crafting your investment strategy today.

Meet the Financial Professionals of Heritage Investments, serving members of Heritage Credit Union. Together, you’ll create a plan that will make those financial goals a reality.

Stocks and Bonds

When you invest in individual stocks, you become a part owner of the business, with all the ups and downs. You can vote at shareholder meetings and receive profits allocated to owners. You may get very high returns, but you may also lose money.

Bonds, on the other hand, are an agreement to loan money to a company or government in return for regular payments. While stocks fluctuate, bonds are often less risky. But with either, you’re counting on that one entity, and that can be risky.

Annuities

Annuities are contracts with an insurance company that can help protect you against the risk of outliving your assets. Annuities provide future income in return for your contributions, and are offered with options based on investment style and payout options. Those options include Fixed Annuities, Variable Annuities, Indexed Annuities and Single Premium Annuities.

IRA

Understanding which Individual Retirement Account (IRA) is best for you is an important first step to saving for retirement while recognizing great tax benefits. An IRA allows you to save for retirement with tax-free growth or on a tax deferred basis.

Managed Accounts

Managed account portfolios come in many different structures, and are customized to meet the specific investment objectives with direct access to investment managers. Some portfolios focus on tax managed investing and others on growth investing with less regard for tax consequences. Some portfolios are more focused on generating income and others on growth.

Mutual Fund

Mutual funds are a good option for members who want to diversify and rely on professional money management to seek their savings goals. With mutual funds investors pool their money into a managed portfolio of securities, allowing access to professional fund managers. These mutual fund managers decide the best time to buy and sell providing you the expertise of investment specialists. Funds vary from aggressive to conservation, covering the full threshold in between.

Check the background of investment professionals associated with this site on FINRA's BrokerCheck.

Stock investing includes risks, including fluctuating prices and loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value.

Investing in mutual funds involves risk, including possible loss of principal. Fund value will fluctuate with market conditions and it may not achieve its investment objective.

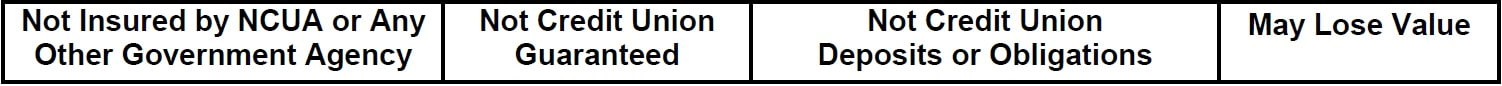

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Heritage Federal Credit Union and Heritage Financial are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Heritage Financial, and may also be employees of Heritage Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Heritage Federal Credit Union or Heritage Financial. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Go to main navigation